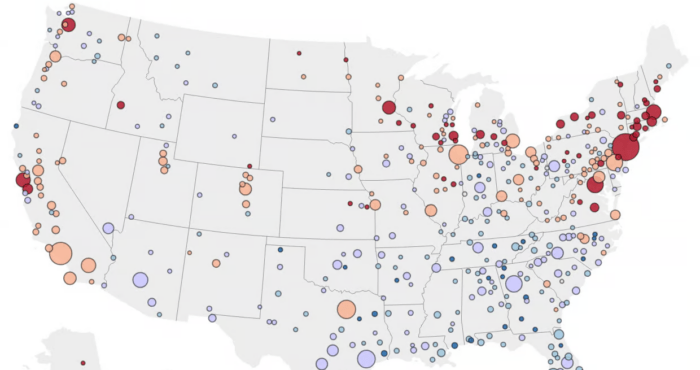

Home insurance rates have increased by almost 20% nationally between 2021 and 2023 and even more in some states like Arizona where rates have jumped 62% in some cases.

The appreciation that homeowners have enjoyed, especially in the past four years, has caused premiums to increase because the values are higher. In addition, insurance is affected by inflation due to the increased cost of labor and building materials used to calculate the replacement cost of the dwelling.

Natural disasters, especially in coastal areas, tornados, fires, and hail are just a few of the things that insurers have paid considerable claims and are driving the prices of premiums higher. Some insurers are pulling out of high-risk areas which make it difficult for homeowners to not only find coverage but at reasonable prices.

There are several things that homeowners can do to lower the cost of their policies.

Increase Deductibles – Opt for a higher deductible to reduce premium costs, but ensure you have sufficient savings to cover the deductible in case of a claim.

Bundle Policies – Combine homeowner’s insurance with other policies such as auto insurance with the same provider to qualify for multi-policy discounts.

Improve Home Security – Install security features like smoke detectors, burglar alarms, deadbolts, and security cameras to reduce the risk of theft and damage, thus lowering premiums.

Upgrade Home Systems – Updating electrical, plumbing, and heating systems to meet current building codes can lower insurance premiums by reducing the risk of accidents or damage.

Maintain a Good Credit Score – Maintaining a good credit score demonstrates financial responsibility and can lead to lower insurance rates.

Shop Around – Compare quotes from multiple insurance providers to find the best coverage at the most competitive price.

Choose a Less Risky Location – Living in an area with lower crime rates, proximity to fire stations, and minimal environmental risks can result in lower insurance premiums.

Stay Claims-Free – Avoid filing small claims, as a history of claims can lead to higher premiums. Instead, consider paying for minor repairs out of pocket.

Reduce Coverage – Review your policy to determine if you have more coverage than necessary and adjust coverage limits accordingly to reduce premiums.

Ask About Discounts – Inquire with your insurance provider about available discounts for factors such as age of the home, non-smoking household, or membership in certain organizations.

Insurance is required on properties with mortgages on them but even when a home is paid for, most homeowners cannot afford the physical loss but also from potential exposure to liability to people who might be injured on their property. It is estimated that the number of American homeowners without insurance in 2024 has increased to 12% from 5% in 2019.

Having an annual review with a property casualty insurance agent ensures homeowners maintain adequate coverage as property values and personal circumstances change, protecting against potential underinsurance. This proactive approach provides an opportunity to discuss lowering premiums, helps identify potential gaps in coverage, offering peace of mind and protection against unforeseen events.